Scientific Article: PGGM

The Holistic Balance Sheet Method as Supervisory Instrument for Pension Funds

In the Netherlands, the supervision on pension funds has to meet the requirements of the European supervision directive, the IORP Directive (Institution for Occupational Retirement Provision Directive). The European Commission (EC) started with a revision of that directive in 2011. Originally, they had three reasons to do that, with two reasons added in most communications in a later stage:

1. Since the first directive from 2003, new member states joined the EU with pension systems which do not fall under this directive;

2. Further stimulation of risk-based supervision;

3. Promotion of the internal market to stimulate cross-border pension funds;

4. Development of pension coverage, especially in the context of poverty among elderly people;

5. Improvement of the role of pension funds as providers of long term capital.

The EC asked EIOPA, the European supervisor, for advice on how to build a harmonized framework that would achieve these goals. To accomplish a harmonized supervision, EIOPA came up with the holistic balance sheet1, HBS.

Design of the HBS

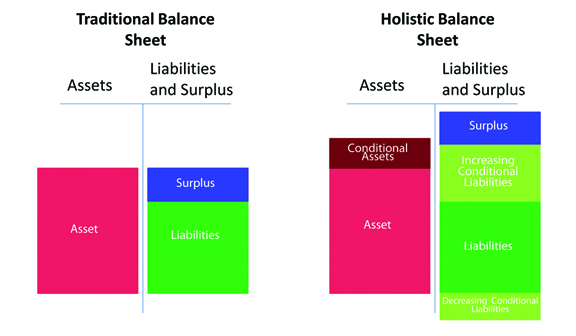

Like the traditional balance sheet, the HBS shows assets on the left side and liabilities and surplus on the right side. The HBS intends to include also the market consistent value of all steering and security mechanisms. See figure for a comparison of the traditional balance sheet with the HBS2. We can see that the balance sheet is extended with conditional assets. For example, one can think of a sponsor guarantee or a rise of the incoming contribution in case of a low funding ratio.

The liabilities are extended with two elements: increasing conditional liabilities and decreasing conditional liabilities. In the Netherlands we have conditional indexation which is given in prosperous times and the possibility to lower pension benefits in bad times.

The idea is that such a balance sheet gives a more complete view on the financial situation of a pension fund. For example, two pension funds with the same traditional balance sheet are not in the same situation when one of the funds has a sponsor guarantee. The pension fund with the sponsor guarantee can have a lower capital buffer to give the same security to the pension benefits.

The calculation of the conditional elements in the balance sheet should be market consistent. This means that the value should be a trustworthy view of the value if it could be traded on the free market. The cash flow of most conditional elements depends on specific circumstances. Think of a sponsor guarantee that only pays out when the funding ratio is below for example 90%. Due to these specific circumstances the conditional elements have the same characteristics as for example equity options.

The HBS faces some challenges

When using the HBS, there are still some open-ends and challenges to face3:

• The calculation of the conditional elements is complex.

While the elements can be compared to standard options, there are hardly any standard formulas to determine the value. The valuation models look like more complex variants of an ALM-model. To meet the supervisory requirements, costs will likely rise. The supervisory demands will ask for more expertise from supervisors, pension administrators and pension fund boards. This gives job opportunities for econometric students who like to combine their technical knowledge with the dynamic pension world and who wants to work in a field of great social importance;

• The calculation of the conditional elements is often subjective and leads to the illusion of accuracy.

The data which is needed for the calculations is often not available. For example, an ‘indexation option’ has a far longer duration than what is commonly traded in option markets and depends on wage and price inflation which is not traded at all. To come to a valuation several assumptions have to be made which can lead to entirely different outcomes;

• Proportionality:

The need for extra expertise and manpower is easier to overcome for larger pension funds than for small ones. The extra costs can be a problem for small funds;

• The HBS surplus is an aggregate figure difficult to interpret.

It is important to understand that the surplus that the HBS gives is not as straightforward to interpret as the surplus in the traditional balance sheet. In the traditional way a higher surplus is always better. The sponsor has a lower risk of additional contributions; participants have more chance on indexation and less on lowering pension rights. In the HBS this does not have to be the case. A higher surplus can come forth from high expected benefit cuts. The higher surplus is in that case a worsening of the situation for the current participants. Or, the higher surplus can come forth due to a higher value of the sponsor guarantee. The higher surplus is then good news for the participants but not for the sponsor. This simple illustration shows that the HBS gives a more complete view on the financial situation of a pension funds but also calls for more knowledge and expertise to ‘read’ the balance sheet.

The HBS is part of more proposals

The HBS has been brought forward as a tool to bring harmonization in supervision and to cope with the many different pension schemes in the EU. Other important parts of the advice are:

• There are proposals about how to value the liabilities. It looks like the preference is the same ‘risk-free’ interest rate as in Solvency II4. This can affect many British pension funds that currently base their funding needs on expected asset returns5.

• EIOPA wants a harmonized security level. In the Netherlands, we currently use a level of 97.5%. We accept that when we start at equilibrium level, we end in deficit once every forty years. If the harmonized security level becomes 99.5% as in Solvency II, we accept that this only happens once every two hundred years. Security buffers will have to rise, meaning that in the short run less indexation will be given, contributions may rise and the chance on cutting pension rights will increase.

• Perhaps a risk margin above the liabilities is introduced. This could mean a rise of the liabilities with 10%.

All proposals are in a phase of consideration. As of this moment, a Quantitive Impact Study is conducted to investigate the impact of the proposals on European pension funds. The first proposal for an official directive is expected in 2013 or later. Due to European procedures which are necessary, the actual implementation of the new directive shall take a couple of years.

About the Authors

Hans Staring studied Actuarial Sciences and Mathematical Finance at the University of Amsterdam (2010). He started working at PGGM in 2010 with a focus on analysis of current and future pension liabilities, the cost-efficient contribution and the actuarial part of the annual financial statement of pension funds. Now he works at the ALM department of PGGM. Hans‘ main interests besides ALM are the new pension contract and the interest rate.

Jan-Willem Wijckmans has studied econometrics in Groningen between 1997 and 2003. He has started working in the field at Cardano, where he has gained expertise in risk management solutions using derivative overlays. Since 2010, Jan-Willem works at the ALM department of PGGM with a focus on strategic risk management. At PGGM, the goal of strategic risk management is to help pension trustees to make better and more informed decisions regarding the financial setup and the strategic investment policy, taking into account the interests of all stakeholders. For this, PGGM has developed state of the art models and methods to support its clients.

Tekst by: Hans Staring and Jan-Willem Wijckmans

[1] See “EIOPA’s Advice to the European Commission on the review of the IORP Directive 2003/41/EC”, 15 February 2012.

[2] For the original HBS as EIOPA presented, see the EIOPA advice, p.73.

[3] The pros and cons of the HBS are more extended described in ‘The design of European supervision of pension funds’, Broeders, Kortleve, Pelsser and Wijckmans, Design paper 6, Netspar, February 2012

[4] Solcency II is the upcoming supervisory tool for European insurers.

[5] For example. I have € 950,- now. I need € 1000,- in two years time and I make an expected asset return of 5% per year. I only need € 907,03 now. My surplus is thus € 42,97. But when I have to valuate with a ‘risk-free’ return of 2%, I need suddenly € 961,17 and my surplus is turned in to a deficit of € 11,17.