Dreaming of a new recession: Alessio Rastani uncovered

Get to know Alessio Rastani: independent trader, enthusiastic teacher and public speaker

For those of you who did not go to the National Econometricians’ Day (LED), Alessio Rastani is a trader and public speaker. Mr. Rastani has been an independent trader for more than ten years. He created a buzz in 2011, stating that he dreams of a new recession every night and that not governments, but Goldman Sachs rules the world. He set up the online platform leadingtreader.com: a website accessible for everyone who is interested in trading. He also gave a very lively and vibrant speech during the LED. Presentations aimed at econometricians can be factual and placid; Mr Rastani, however, definitely shook the audience up with his interesting and informal performance. ½

Women generally dislike beer because they do not know how to drink it properly

Some of us know you from the LED. How did you enjoy speaking there and was it different from other conventions you have spoken at?

I really enjoyed it. When I accepted the challenge, honestly, I did not know that the audience would consist of econometrics students only. I was actually a bit uncomfortable, afraid that I would get kicked in the backside, since my opinions are a bit unconventional, maybe even offensive to some of the econometrics students. Do not get me wrong, I really think econometrics is a fantastic profession, but what I said was a bit controversial so I was scared that some of you may have felt offended. For example, I mentioned a quote from Peter Lynch. He said: “If you spend more than 13 minutes analyzing economic and market forecasts, you have wasted 10 minutes.” I meant to say that from an investing point of view, it does not really matter that the economy is in bad shape. On the contrary, the best time to invest in stocks is when the economy is terrible. Most people do the exact opposite and become so scared that they stay away from investing in the stock market. That being said, the LED was a fantastic event. There were a lot of smart people over there. I honestly believe that in the UK, we can learn a lot from Holland. I think you are generally smarter than the people in the UK. Unfortunately, I could not stay very long that day, so I did not really get a chance to talk to the students.

If you have to choose one of the two, are you a trader or a public speaker?

I am more of a trader, I do not do that much of public speaking. However I would like to do more of it. At school, I always got into trouble for talking too much, because I just enjoy talking so much. I love to do both. I like to trade, to talk about it and to share my opinions with other traders. Traders are quite the show-offs and they like to talk about themselves and their profession. What I personally hate, is to go to a presentation and to be bored to death. The thing about public speaking I love, is to get the audience involved. In my opinion there is no point in standing there and teaching when no one is listening. You have to get the audience interested. I may have gone a bit too personal during the LED, talking about my hair and the medicine I was taking from a pharmaceutical company, Merck. I bought the shares of that company, so I wanted to know more about it. I even talked about Viagra, since the producing company Pfizer, is also an amazing company. I thought the Dutch would not mind me talking about these topics; you are open-minded. But looking back, I maybe should not have talked about Viagra (laughs).

During your presentation, you told us to go home and buy NVIDIA stocks. Do you usually follow your own advice?

Yes, I would never ever recommend buying something that I would not buy myself. NVIDIA makes a graphic card that is used by pretty much every computer. The reason, I said, to buy NVIDIA, is that they make a technology for new, self-driving cars. Not that I want to bore you with cars, but I think self-driving cars are the future, so that is why I said buy NVIDIA. The stock prices actually did go up over the past months, by the way. However, I try not to tell people that they should buy stocks in a particular company, because I do not want to be responsible for them losing their money if my predictions turn out to be mistaken.

Most traders like to keep their strategies a secret. Why did you decide to teach

other people how to trade?

A lot of people ask me: “Why do you not just keep that information to yourself?” There are a lot of cynical, skeptical people out there and you know what, that is okay as well. It is reasonable to question my intents. The reason I set up leadingtrader.com is that I enjoy trading and sharing my knowledge with people. I do not like this “scarcity mentality”, the kind of mentality that says I cannot share this information, because it is mine. Believe me, there are many people out there, even some friends of mine that will not share their information, not even when you pay them a lot of money for it. I do not enjoy being selfish and keeping everything I know to myself. My grandmother, whom I was very close to, used to be a teacher. Well, I actually come from a family of teachers. Part of my personality is that I love teaching, I probably got it from her and I wanted to be as good of a teacher as her. That is also one of the reasons I became a public speaker. It is not that I have a great voice or that I am that attractive (laughs), but I love to teach people. I made some huge mistakes in my life. Fifteen years ago, I bought stocks at the most terrible time. You have probably heard about the dot-com crash. I was one of the idiots that lost a lot of money. I had turned 50,000 pounds into half a million, and then I lost everything, including the money I started with. I have made every single mistake in the book, so I really want people to learn from these mistakes and save them money. Maybe 80 percent of the audience does not remember a single thing from the seminar and they will make the same mistakes as I did. However, I am confident that at least 10 to 20 percent will remember what I said and that I helped them not to make those mistakes.

The thing about trading is, it is a very selfish profession

After the dot-com crash you wanted to become an independent trader. For most people this will always remain a dream. How did you manage to become a trader, especially since you studied dentistry and law?

Well, I studied some physics to get into dentistry. See, my parents really wanted me to become a doctor, but I was not smart enough so I got into dentistry. I really hated it, despised it. I would not recommend it to anyone. Again, due to my parents, I switched and started my law study. It was either that or medicine. I did really enjoy law though. Law is actually quite similar to economics. It follows a logical pattern, if you follow the formulas you get a result. After my graduation, through my work, I met a lot of traders. A friend of mine, a trader from Goldman Sachs, gave me a lot of information that I still use. But I did not become a trader because of him. I have always been interested in how to make money from stocks. One of the things he told me is that, the worst thing you can do is to rely on someone’s tip or advice. I do not like to tell people what to buy. I mean, what if I am wrong? What if the economy changes or the company you just invested in has bad news? You need to know how to do it for yourself. I needed to know how to do it for myself. After the dot-com crash, I managed to make my money back. It took a long time. I had some very good mentors, friends of mine, who helped me. That is how it all started. I watched one of them turn 14,000 into a 100,000 which was amazing. You do not go into trading just for the money. You should enjoy the subject that you are studying. It is always a bad idea to do something just for the money. I mean, for example, imagine going to a doctor that just wants to make money out of you. That is never a good doctor.

So you studied dentistry and law. How did you enjoy your student life?

I loved it! I was a terrible student though. I mean, during my first year at law I failed pretty much every exam. Not that I was stupid, I just did not study at all. You know what happens, I went partying, joined the drama club, those things. I did acting, comedy and pantomime, I even played Joker from Batman. I was not as good or as scary as Heath Ledger though. Funny fact, I was probably the only guy in the drama club that came for the acting, the others just came to find women (laughs). I hope they do not read this interview. My teachers almost expelled me from university. I did not go to any of the lectures and my attendance record was terrible. I had to resit all of my exams. Looking back that was a big mistake, I really wish I had studied harder. It was only during my second and third year that I got good grades. I did not manage to get a first as an average (highest possible grade), sadly, but I got the next best grade which is a 2:1. I know, I could have had a first; I hate to be second best. Anyway, that shows that you do not have to be smart to be a trader. If I can be honest with you: if there is one thing I want to do in my life, it is going back to university. I loved it. I do not think anybody says that they enjoyed the studying. I actually want to go back and study medicine. The thing about trading is, it is a very selfish profession. You make money; it is you against the market. Even though I enjoy it, it does not always feel right. You can give money to charity of course. But that is not the same as the value you add by studying medicine. You always need a doctor.

You were only a member of the drama club during your study. If you would go back to the university, would you join any other clubs or associations?

There are no particular clubs or associations I would like to be a member of. I would have liked to run my own church though. Not that I am extremely religious, but I do thank God every day for what life has given me. One day I would like to become a pastor. I have considered this and I hope to make it happen at some point in the future.

Do you have hobbies besides speaking and trading?

Right now, my only hobby is working out and trying to get fit. You know, the problem with trading is that you are always in front of your computer screen. It is really important to have somewhat of an active life. Do sports or go to the gym. That is what I do most besides my work, swimming and going to the gym. I also love running. I got into exercise mostly because I put a lot of weight on last year. It was so bad, I bought a suit last year in Holland and I had to throw it away. When I lost the weight, it did not fit me anymore. That is probably the best thing I have ever done: get active and healthy. It really keeps your brain flowing and it helps your trading as well. You make much better decisions. A lot of rubbish is written about losing weight. The same goes for trading. Every magazine or book has some simple, easy strategy to make money or to lose weight. My advice to your readers: do not believe any of that. I am not saying that trading has to be difficult, not at all. It is very understandable, but you have to put the hard work in. You cannot just read something on the Internet and become an instant trader. Do not fall for the traps. It is the same with losing weight; there are no magic diet pills. I hated being fat, that is why I changed my life. I went to the gym and changed my regime. I learned another thing from going on a diet, that is also applicable to trading. Many people research it and go from one strategy to another. They just hop from one approach to another without staying true to some sort of game plan. The weight-loss industry is just like the trading industry, both are multi-billion dollar industries. As long as you keep your net intake under 1800 calories a day, you will lose weight. The same thing goes for trading. You do not need any amazing innovate techniques I have been using three great strategies for years and I still use them today. I just improve them every now and then. The important thing to remember is: stick to something that works.

Life is not about money or success

Could you tell us something about those three strategies? Things you may have learned during your years as a trader?

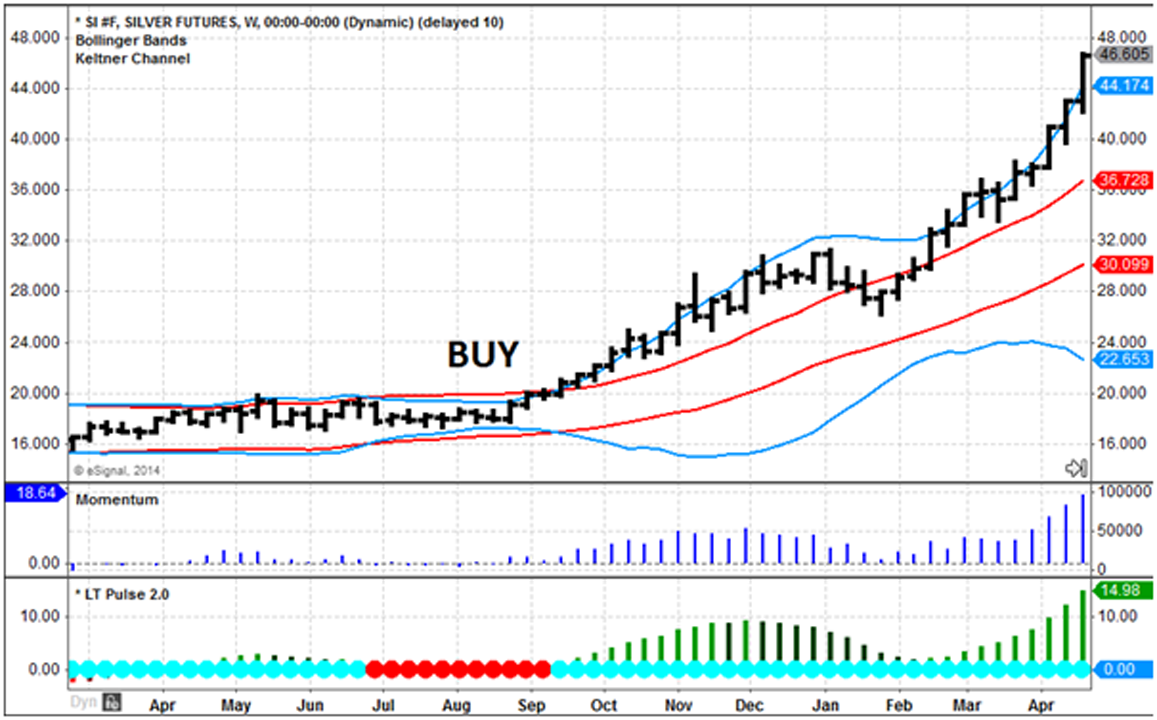

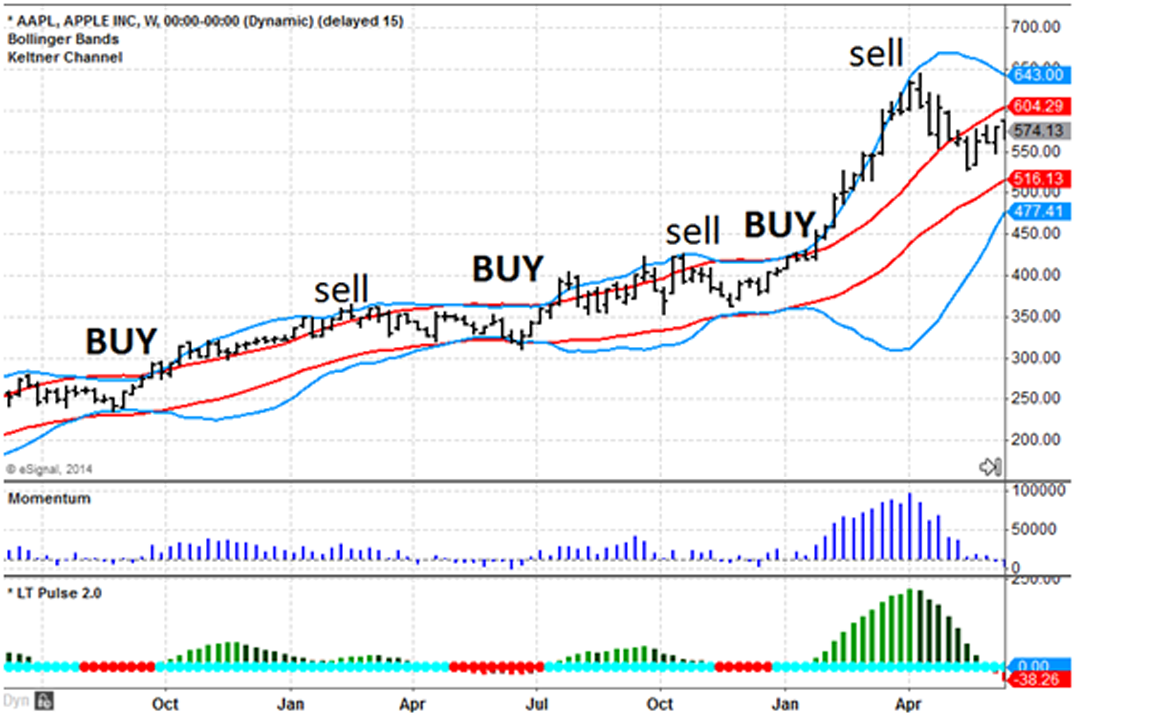

Of course, I will try to explain it briefly. One of my methods is called the pulse-method. Basically the markets go through phases, just like economies. There is a cycle in the markets. Periods of low volatility are followed by high volatility, so one of my main strategies is how to find where the markets change from low to high volatility. This picture shows all the indicators I use. The red dots signify periods of low volatility. It is like a traffic light: red means stop do not do anything. When it goes to blue, do something. Red means be careful, do not do anything but be prepared because the market is going to explode. The biggest problem is how to find that moment of transition. Most people jump in too late, when the transition has already taken place. One of the reasons people lose money is because they wait too long. You want to jump in at the exact moment when the markets change from low to high volatility. You will always have trades that do not work out. It only needs to happen a few times to make big money. Just make sure you never lose too much money, keep your losses small. When the bars are green, the momentum is increasing. You want to start buying when the momentum increases. You simply hold and you sell either when the momentum dies out or you exit when the moving average goes down. I use the eight-period moving average. As soon as the price goes below the eight-period moving average, I go out of the market. I never do anything until the red dot appears again. I apply it to many markets; silver, gold, coffee. I use a number of different methods, this is just one of them. I will explain quickly how the red dots appear and why this works. You can do this on any broker platform online. Please keep in mind that I did not invent this strategy, I just improved on it. You only need three indicators: Bollinger bands, Keltner channels and momentum. Every charting platform will have these indicators. You select these volatility indicators and change the momentum to a histogram. Essentially, how this works: the blue lines are the Bollinger bands; the red ones are the Keltner channels. Now, when the Bollinger bands go inside the Keltner channels, the red dots appear. That is how you know the market has low volatility. I call this a pulse. Some American traders call it a squeeze. When the lines intersect, I always say that the blue lines are making love to the red lines. I guess it is a bit like sex (laughs). They are making love and it leads to an explosion. When the Bollinger bands are inside the Keltner channels the market is going to explode, quite literally. The moment you take action is when the Bollinger bands come out. Your action depends on the momentum. The momentum is negative or positive and that tells you whether you have to buy or not. This is one of my favorite strategies. Another important thing is how to keep your money. There are two things to wealth: one is how to make it and two is how to keep it. One lesson I learned from the dot.com mistake is that in trading, even though it sometimes looks simple, people tend to rely too much on emotion. You really need to be able to stick to your strategies.

You talked about your mentors before. Are there people you admire?

Yes there are. Some of them have stopped trading. One of them is Paul Tudor Jones, one of the traders interviewed in the book ‘Market Wizards’. I like some of the things he said in his interview. He said that one of the main points you have to focus on is not to lose money when you try to make money. He focuses mainly on taking care of risks. He said that 80 percent of your profits will come from 20 percent of your trades, and it is true. A lot of your trades will not work out. Some will make a little money, some will be break-even and others will cost you money. Only 20 percent will be big massive winners. Knowing how to stick with a winning trade is one of the most difficult things you have to do. There is going to be a voice inside your head that will tell you to get out since you made all that money. When you give in, you will see that the market has gone another 100 percent up without you. That is the hardest part of trading. That voice will do a lot of damage. It works the same way when you are losing money: you hope that it will get better if you stick around a little longer and then you end up losing more.

Is there anything we have not asked you, that our reader may like to know?

Well what I would like to know from you, is how your company Heineken makes their beer. It tastes amazing. I actually went to the Heineken museum. One of the guys told me something about drinking beer that I think a lot of traders could learn something from. Do you know why women generally dislike beer? They do not know how to drink it properly. I am not being sexist, but you need to drink it like a man. You have to drink beer with big gulps. Otherwise you just drink the bitter top part, while you need to drink the sweet, golden part. Most women take ‘petite’ sips from the top. If you drink beer like that, you just drink the bitter part. So if you change just one thing about the way you drink beer, it will taste different to you. The same goes from trading: you can change just one thing and you will have an improved result. It can be a massive difference.

Is there any final advice you would like to give our readers?

I would like to share one of my favourite quotes from Steve Jobs. He said “Being the richest guy in the cemetery does not matter to me. I want to go to bed at night knowing we have done something wonderful today. That is what matters to me.” I love that quote. In trading, sometimes it is all about the money. But in the end, does it really matter? Steve Jobs, one of the richest men in the world, passed away. All that money, what does it get you in the end? So focus on enjoying life, enjoying your work. Get out more; in the end you do not know how long you are going to live. I recommend reading a book called, “The Top Five Regrets of the Dying” by Bronnie Ware. The author worked in a cancer clinic and wrote down everything her patients regretted at the end of their lives. It really changes the way you look at life. Life is not about money or success. Steve Jobs had a lot of money and was extremely successful. At the end of the day, he is not with us anymore.

We thank Alessio Rastani for his time and the lovely interview.

Text by: Nicole Verbeek