Investment Strategies Under Scrutiny

It all started on January 31, 2012. An information technology consultant named James Rogozinski had some spare money that he wanted to invest. Regularly, he went on different forums and asked for advice. Most of the time, he received the advice that his choices were too risky and that he was never going to win. Disappointed by the dull comments he received, he decided to create his own forum ‘r/WallStreetBets’ on Reddit. A place where like-minded people could discuss their trades, which actually resemble gambling more than rational trading. Little did he know that eight years later, this forum would frighten the big institutions of the financial markets. Written by: Jarno Ringhs & Mylan Tran

The development of the platform

During the last few years, r/WallStreetBets had only a couple of thousand users, but this changed in 2019. During this year, several brokerage giants eliminated trading commissions from their apps. It resulted in trading being much more accessible for the public. In addition, people had a lot of spare time during 2020, because of the pandemic and all the lockdowns that were implemented across the world. Due to these two factors, the number of ‘degenerates’, as the amateur investors call themselves, went through the roof. A few thousand users became a few hundred thousand in a short amount of time. There was also an unpleasant side to all of this. The amount of offensive content on the platform grew. Mr. Rogozinski himself discovered a private chatroom on Discord that was filled with racist, antisemitic, and antigay comments. He deleted the chatroom and also kicked out some of the moderators that let this happen. Eventually, this resulted in some backlash for him. This, in combination with some other actions, was for multiple moderators a good reason to kick the founder off the page. Mr. Rogozinski has therefore not been able to moderate the community since April of last year. Now in 2021, his forum was the start of the trading insanity surrounding the company GameStop [1].

Short and long for dummies

Before we go into detail on how r/WallStreetBets started the trading frenzy around GameStop, we will first illustrate a trading strategy that was used by the large hedge funds: short selling. For the people who followed the GameStop mania, understanding short selling is a piece of cake. In this section, which is designed for dummies, we will explain short selling in such an elaborate way that everybody will be able to understand how this trading strategy works. At the end of this section, we will also briefly discuss its counterpart: establishing a long position.

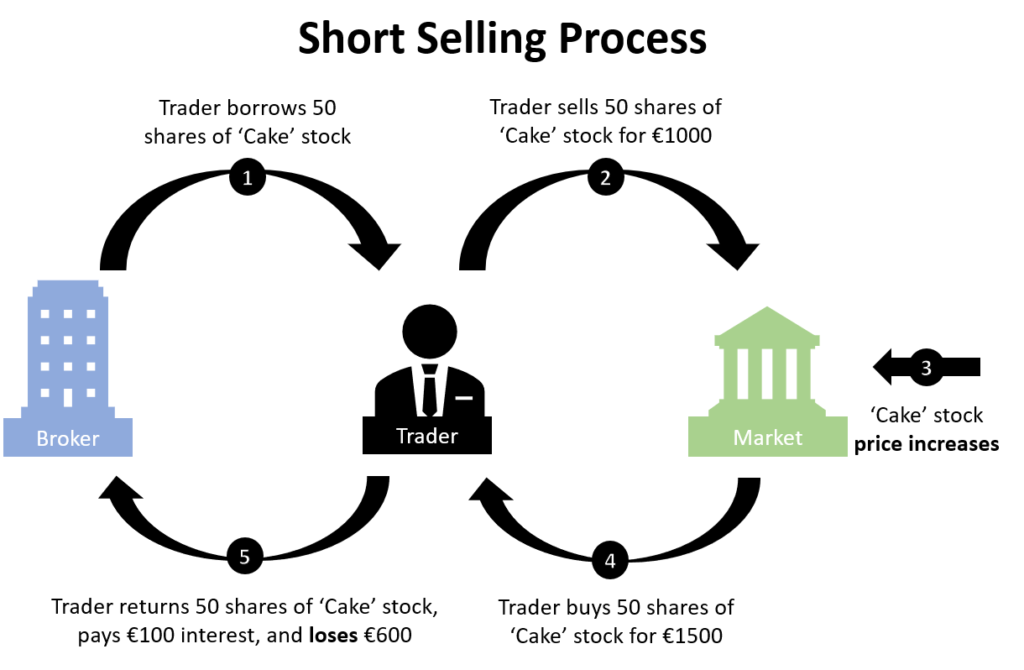

Short selling is mainly motivated by the belief of a stock’s investor that the price of a security will decline in the future [2]. Therefore, speculation is the word that we are looking for when describing the idea behind short selling. Investors speculate on the depreciation in value and will act accordingly upon their speculation. Intuitively, one might think that we want the prices of the assets that we own to increase, not decrease, right? Then, we can sell the shares at a higher price than what we purchased them for. However, short selling would obviously not exist if you were not able to earn some money with it. Before describing the process of short selling, it is important to note that it is a rather untraditional way of trading. The investor, in this case, does not actually own the shares of the stocks, bonds, or other assets that he is going to sell. Instead, the trader opens a short position by borrowing the shares from a broker (or lender) that he thinks will drop in price on a given date – its expiration date [3]. Note that borrowing is only possible if the stock is not already ‘shorted’ by other investors. After borrowing the shares of interest, the investor will sell these shares to any buyer that is willing to pay the current market price. Consequently, the investor will be ‘short’ because he sold something that was borrowed and therefore not in his possession. After a while, the investor can close the short position by buying the shares back on the market for a lower price than what he borrowed the shares for. Finally, he will return these shares to the lender. We should, however, not forget that the trader has to take the interest rate charged by the lender on the borrowed shares into account. Nevertheless, if the strategy is well-executed, the trader will make a profit (hooray!). We will demonstrate the principle of short selling in the example below:

Example

Suppose that a nonexistent stock — for story purposes, let us call it the Cake stock – has a price of 20 euros at the moment. A trader speculates on the decline in the price of ‘Cake’ in the next few weeks. So, the trader will borrow 50 shares of ‘Cake’ from his broker, after which he will sell them for the price of €20 each on the market. After two weeks, the ‘Cake’ company states that they are financially not doing so well. Hence, the stock price drops to €10. The trader will now close his short position at €10 by buying 50 shares of ‘Cake’ and return them to the broker. Now if the broker charged an interest rate of €100 (again, this is a non-realistic example) the trader will gain a profit of 20*50 – 10*50 – 100 = €400!

Although short selling is untraditional, it is not uncommon. Diether, Lee, and Werner (2009) stated that this strategy makes up for around 30 percent of overall trading [4]. However, this is not an incentive for you to start short selling because it is intriguing to start making money out of ‘nothing’. Taking the same example as before, we can also see that there is no such thing as a free lunch:

In this nightmare scenario, the trader did not close his short position at €10 but took a risk by waiting for the ‘Cake’ stock price to decline even further. Unfortunately, there is an unexpected soar in the value of the ‘Cake’ stock due to a new CEO, pushing up the price to €30. The trader now has no choice but to close the short position at this much higher price and obtain a loss of 20*50-30*50-100 = €600.

As you can see, an unanticipated increase in stock prices instead can stand in the way of the short seller’s strategy. This forces short shellers to cover their short position by buying back the shares of the stock, stated by Investopedia [3]. However, all traders want to diminish their losses by buying back the shares as soon as possible. Hence, a domino effect will arise where the high demand pushes the price even further. Consequently, there will be a lack of supply and an excess of demand for the shares of the stock. This phenomenon is what we call a Short Squeeze. Filippou, Garcia-Ares, and Zapatero (2021) stated: “(..), a short squeeze can be triggered by positive news, earning announcements, and abnormal trading volumes.” [5] The latter cause is what happened to the stocks of GameStop.

Now that we have explained what short selling means, you might be curious about its opposite: going long on a stock. Going long is also described as holding a long position. It means that the trader buys and owns stocks with the expectation that the prices will increase over time [3]. You often read that the investor is bullish in this case, which is just a fancy word to say that he thinks the securities’ prices will rise. The term ‘long’ can also refer to the length of time of a long-position investment because traders who perform this strategy are usually not eager to sell their assets after a short period of time.

The power of the degenerates

The GameStop saga started with a person named Keith Gill. He had his eye on the stocks of the firm. GameStop is a gaming retailer that is mostly dependent on selling physical copies of games. Due to the fact that an increasing number of people download their games from the internet, the business model of GameStop is pretty outdated nowadays. However, in Keith’s view, the stocks of the firm were undervalued. On his YouTube channel, he explained how he came to this conclusion. Eventually, he shared his thoughts with the WallStreetBets community. At the same time, it was discovered that 48% of the stocks of GameStop were held as short-positions [6]. As mentioned in the previous section, this means that the hedge funds involved were speculating that the stock price would decrease, executing their short selling strategy. Meanwhile, one of the members of the forum on Reddit posted a long thread called ‘Bankrupting Institutional Investors for Dummies, ft. Gamestop’. He concluded in the thread that the hedge funds were exposed to a much higher risk than the ‘degenerates’. The users of the forum would only lose the money they invested if the firm went bankrupt, but the hedge funds could lose an infinite amount of money if the price of the stock would skyrocket. The degenerates, mostly amateur investors, then decided that they would take on these hedge funds by buying large amounts of GameStop stocks.

In the end, the plan of the ‘degenerates’ succeeded. The increase in demand for the GameStop share resulted in an immense price increase in the second half of January 2021. At some point, the hedge funds had to accept their losses and buy the GameStop shares back in order to close their short positions. This stimulated the price to rise even more. The members of the forum, who joined in from the start to buy GameStop shares, made huge profits. Moreover, they were encouraging each other to hold on to their shares to maintain the high price. On the forum, this phenomenon is called ‘diamond hands’. However, RobinHood, one of the big investment apps, concluded that the situation was out of control. Therefore, on the morning of January 28, they made it impossible for users to buy GameStop shares on their platform [7]. People were only able to sell their stock which resulted in a price decrease and big losses for a lot of investors. Many of them held on to their stocks, because they believed that the big hedge funds had to buy back the shares sooner or later. This determination is the reason that the war on GameStop is still going on. Nonetheless, the private investors were not the ones who came out as the big winner. Several Wall Street companies did not let an opportunity to make a good amount of money pass [8]. In total, nine investors like BlackRock and Fidelity’s FMR made an amount of $16 billion on their GameStop stakes in January. This is more than three-quarters of the total $20.4 billion gain in the company’s market value during the first month of this year [8].

One thing this saga has shown us is that the power of the people is unlimited when they unite to fight for the same goal. Although several social media companies banned the degenerates’ groups from their platforms [9] and the SEC (Security and Exchange Commission) is investigating their platforms on fraud [10], these investors still persevere. As of now, r/WallStreetBets is even targeting other companies such as Nokia, Blackberry, and electric carmaker Nio. Hence, it is definitely worth it to keep following the developments in the financial market!

References

[1] Akane Otani (2021), WallStreetBets Founder Reckons With Legacy Amid Stock-Market Frenzy, The Wall Street Journal.

[2] Kot, H.W., Chen, M., Cheung, A., and Huang, H. (2019). Understanding short selling activity in the hospitality industry. International Journal of Hospitality Management, 82, 136-148.

[3] https://www.investopedia.com/terms/s/shortselling.asp (2021). Short Selling. Investopedia, February 28, 2021.

[4] Diether, K.B., Lee, K., and Werner, I.M. (2009). Short-Sale Strategies and Return Predictability. The Review of Financial Studies, 22(2), 575-607.

[5] Filippou, I., Garcia-Ares, P.A., and Zapatero, F. (2021). Short Squeeze Uncertainty and Skewness Available at SSRN: https://ssrn.com/abstract=3437085.

[6] https://www.investors.com/etfs-and-funds/sectors/gamestop-stock-here-we-go-again-most-shorted-stocks-back-play/ (2021). Here We Go Again: GameStop, 10 Most Shorted Stocks Back In Play. Investor’s Business Daily, February 1, 2021.

[7] https://www.theguardian.com/business/2021/jan/28/gamestop-shares-robinhood-app-ban-blackberry-amc-nokia-reddit (2021). GameStop shares plunge after ban by Robinhood app. The Guardian, January 28, 2021.

[8] https://www.investors.com/etfs-and-funds/sectors/gme-stock-gamestop-investors-instantly-make-16-billion-gamestop-stock-squeeze/?src=A00220 (2021). Nine Investors Instantly Make $16 Billion On GameStop Stock ‘Squeeze’. Investor’s Business Daily, February 1, 2021.

[9] https://www.theguardian.com/technology/2021/jan/29/facebook-shuts-popular-robinhood-stock-traders-group-amid-gamestop-frenzy (2021). Facebook shuts popular Robinhood Stock Traders group amid GameStop frenzy. The Guardian, January 29, 2021.

[10] https://www.bloomberg.com/news/articles/2021-02-03/sec-hunts-for-fraud-in-social-media-posts-that-drove-up-gamestop (2021). SEC Hunts for Fraud in Social-Media Posts Hyping GameStop. Bloomberg, March 9, 2021.