The Perfect Sandbox

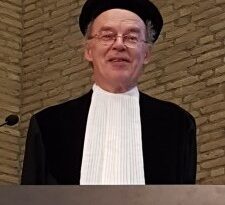

On a Monday evening, former Chairman of TEV (predecessor to Asset | Econometrics) Arnoud Klep returned to the campus once more. After a full time board year in ’99-’00, Arnoud graduated in ’01 and the study association has never left his heart. After having been republished in Nekst 1 (vol. 25), he reached out to the Nekst editorial staff; a few months later, we have found an opportunity to catch up and reminisce. We could not wait to ask him about his experiences from back in the day and about his current career.

Text by: Pepijn Wissing

Arnoud

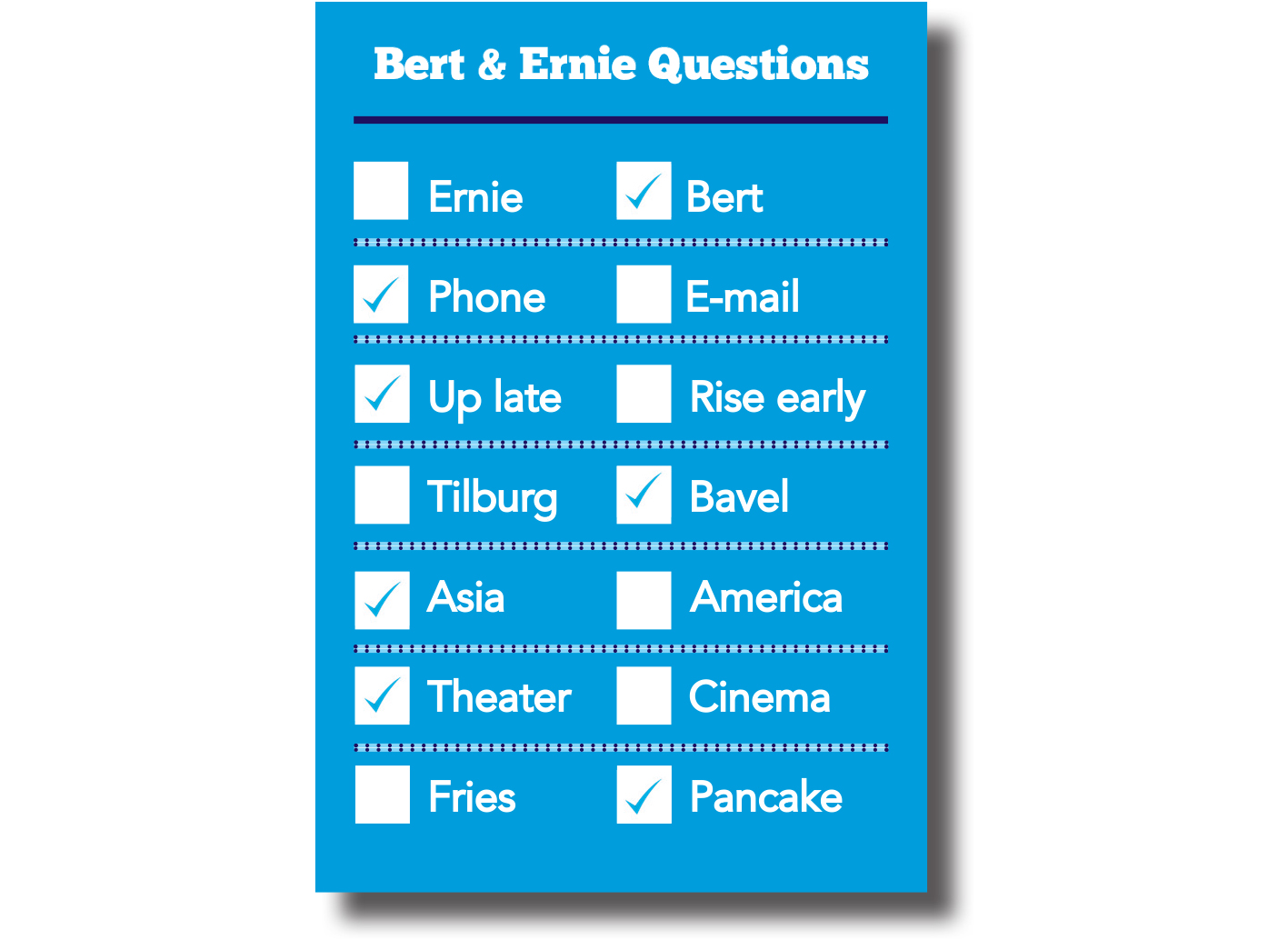

Currently, Arnoud spends most of his days in Rotterdam working for the asset management company Robeco. He first came into the company for a graduation internship, and has not left since. He lives in the picturesque town of Bavel, close to Breda, with his wife Brenda, with whom he has been married for nine years, and their two daughters Julie (4.5) and Marlou (1). As a matter of fact, Brenda is also an econometrician from Tilburg! They got together around the time of Arnoud’s graduation. “Our friends always said that we were meant for each other, but during our studies it just never happened. Evidently, they ended up being right anyway!”

“Integrity, harmony and loyalty are three words that I think do fit me very well.”

When asked about his life choices, Arnoud tells us that he is not typically one to doubt himself. “Of course, one can always obtain new insights,” he says, “but given the same information, I will come to the same conclusion after my choice process; I know what I want.” This has held true from his choice of studies, to the more recent career choices. Over the years, he has held quite a few positions at Robeco, starting off as a Quantitative Researcher after his internship, making a few internal switches and currently holding the position of Portfolio Manager Quantitative Equities. “Integrity, harmony and loyalty are three words that I think do fit me very well.”

Learning

A big smile appears when Arnoud is asked to reminisce about his time at Tilburg University. “It is funny, really. Back then, the financial situation was quite challenging, but we had all the time in the world to do what you liked – although we may not have seen that at the time. Nowadays, it is the other way around: there is more room financially, but time is always scarce.” All in all, Arnoud thinks back to that time as a carefree period, in which one makes real steps towards adulthood, and in which one is formed as a person. “It is quite amazing, the amount of knowledge that one is able to acquire in so little time.”

Once you actually start your work in practice, you do start from scratch in a sense

Not everything is learned at the university though. “The work I am doing currently, I would not be able to do without the basis I built during my time at the university; you really need that. It is a way of thinking, a way of approaching problems, that is being handed to you in your studies. On the other hand, once you actually start your work in practice, you do start from scratch in a sense. All in all, I think I have learned the most in practice, but I would not have been able to learn those things without my studies. Of course, it does make sense that one would learn the most in practice, seeing as you work for forty years and you only study for four!”

Portfolio Manager

As a portfolio manager, one is essentially responsible for managing a large pool of investments on behalf of clients. The same goes for a Portfolio Manager Quantitative Equities at Robeco, where a systematic investment policy based in quantitative techniques is applied. One of the primary tasks is the day-to-day management of the portfolio itself, as well as interpreting the investment results, indicating why certain allocations in the portfolio have performed well or not, and placing macro-economic, geopolitical and societal trends in the world around us into financial perspective; “In the end, clients want investment stories behind the portfolio returns”. Moreover, portfolio managers are also important in the acquisition process. When a potential client is almost ready to invest with Robeco, portfolio managers may be asked to provide the final push. “Even though you are following a rules-based investment process, you are still the face of the company to the outside world. It is an approach than that of a fundamental investor, who analyzes balance sheets, makes predictions and analyzes cash flows.”

Furthermore, Arnoud is involved in a few of the international branches of Robeco in Scandinavia and Japan. “While I am not the person you should stick in a hotel for several times in a months, the occasional trip to Copenhagen or Tokyo is really nice! Getting to see the world is a beautiful added benefit.” Sometimes, these trips do involve interesting culture shocks. For example, the Japanese unwritten rules about doing business are really something to get used to. “It was interesting, when even the order in which we entered the room and the way we read one another’s business cards was of importance to the meeting afterwards. It is purely a matter of culture, which has its charm, I have to say.”

Development

“I have never been one to sit back and see what comes my way; rather, I have taken matters in my own hands,” Arnoud says, when asked about his career at Robeco. Personal development is of great importance to him, and his current position should offer plenty of that, for many more years. “It is all curves, really; curves with diminishing returns, to be precise. At first, the graph is steep and you learn a lot, but over time the graph becomes flatter and flatter, at which point one should wonder what to do to make it steeper again. For example, I have taken several personal development courses at Robeco, but the switch to a new position within the company has also offered me a new challenge several times.”

“I have never been one to sit back and see what comes my way; rather, I have taken matters in my own hands,”

Arnoud has always been a motivated student. “Of course, I am happy to have been born with my fair share of intelligence, but I have always tried my best to succeed. I have completed my Bachelor in three years, and my Master in another three.” During his Master, Arnoud discovered the TEV-life: first, he was chairman to the congress committee, after which he spent a year being chairman of the study association TEV. “It might sound like a huge cliché, but it really was a time in which friendships for life were forged. I still talk to my fellow board members on a fairly regular basis; we have been able to continue our yearly Christmas dinner parties for a long time. Moreover, it was at that time that I met my wife, of course! All in all, I look back at that time with a lot of satisfaction.”

TEV

We ask Arnoud what he thinks was the biggest challenge to overcome during his time at TEV; his answer may be quite surprising to the active members of recent times. “In retrospect it was not that big a deal, contrary to what we thought at the time. At the time, there was quite the divide between the congress committee and essentially the rest of TEV. The so called WBS congress was one of the best events organized by the economic faculty with plenty of renown among companies, respected speakers and a huge financial upside; the congress committee worked very hard for a period of 18 months to get it all organized. At the time, this lead to quite some friction between the congress committee and the rest of TEV, who organized mostly informal events. This even got to the point where there was one congress committee perforator, and one for everyone else! One of the challenges that we set ourselves when I and my fellow (previously not active) committee members became the congress committee was to put a stop to that nonsense. It was still a sensitive issue early on, but eventually it all worked out.”

While Arnoud does not keep up with the latest ins and outs at the university and the study association, it is something he can be really proud of. “I do feel proud when I think about how far we have come and how everything has continued to become more professional and more beautiful. When you bear that kind of responsibility every single day for a little over a year, that does not just leave you when you leave it in the hands of your successors. That group of people becomes a part of yourself.”

A board year

Altogether, Arnoud would recommend a board year without a shred of hesitation. In his opinion, it is such a unique phase of one’s life, in which one develops himself as a human being, that it would be a shame to not complement the knowledge obtained through one’s studies with the skillset that is developed during a board year. “How should I have known how to write a letter that is convincing to a company, or how to present myself at an event properly? Those are not things that are naturally learned in the econometrics program, but they are of immense value.” In what has become a passionate plea, Arnoud may have hit the nail right on its head when he calls a board year the perfect sandbox environment, in which you get the opportunity to learn such things in a practical manner.

“It is amazing to be able to be a part of a team that provides others with the opportunity to develop themselves; it has always given me so much positive energy. For example, when the nobody wanted to organize the national econometricians day in ’99, we decided to shoulder it and managed to make it a success in a mere seven weeks; that is an experience we were only able to pull off due to a very solid base of enthusiastic active members to work with, and a hefty dose of commitment.”

While Arnoud admits not nearly everything has gone their way, he thinks he has learned many invaluable qualities. For him, personally, being able to trust in fellow committee and board members, the art of being able to let go and to let people come to their own conclusions are all things that have matured during his board year. “I value the harmony of a group immensely. Of course, there will always be differences of opinion, but when we are done with a meeting and close the door behind us, we should be able to put those aside and get along. Team spirit and coherence are extremely important.”

As a chairman, Arnoud has learned to use his final say not too frequently, but just enough. While using that power too often will generally not motivate people, especially so in an association that is built on volunteers, doing it too little may cause him to not be satisfied with the result of a project. “At the end of the day, a good chairman should be able to position his team in the strongest possible formation; he should play to people’s strengths. Moreover, being able to connect and build bridges is also extremely valuable.”

That is not to say it has always been all work for Arnoud. Sometimes, when he would feel the need to clear his mind for a little bit, he would go find the public piano that was located in the building close to the TEV rooms, and just play away for a little while. These days, however, I hardly play out of romanticism anymore. When I take a seat behind my piano at home, it is almost always to play K3 songs!”